x

Our website uses cookies. By continuing to use the site, you agree to our use of these cookies. To learn more about how we use the cookies and how you can manage them, please see our cookies policy.

When a company faces insolvency, it nearly always has a detrimental effect on employers and employees alike. Some employees may find another job, others may find themselves unemployed with no prospects. If the company you work for becomes insolvent, there are certain rights that help to protect you from financial stress, however, what happens if your employer does not adhere to those rights?

In this guide, we will explore the insolvency laws in England and Wales, as well as your rights if your employer becomes insolvent, also when it is appropriate to consider legal action. We will also discuss what steps your employer should take when made insolvent, and how our expert insolvency lawyers at Giambrone and Partners can help.

Click on the links below to jump to that section:

Discover more about insolvency laws you need to be aware of

Find out what your rights are should your employer becomes insolvent

If you believe you have been treated unfairly, you may be able to take legal action

Here are steps your employer should take if their company becomes insolvent

Here’s how we can assist

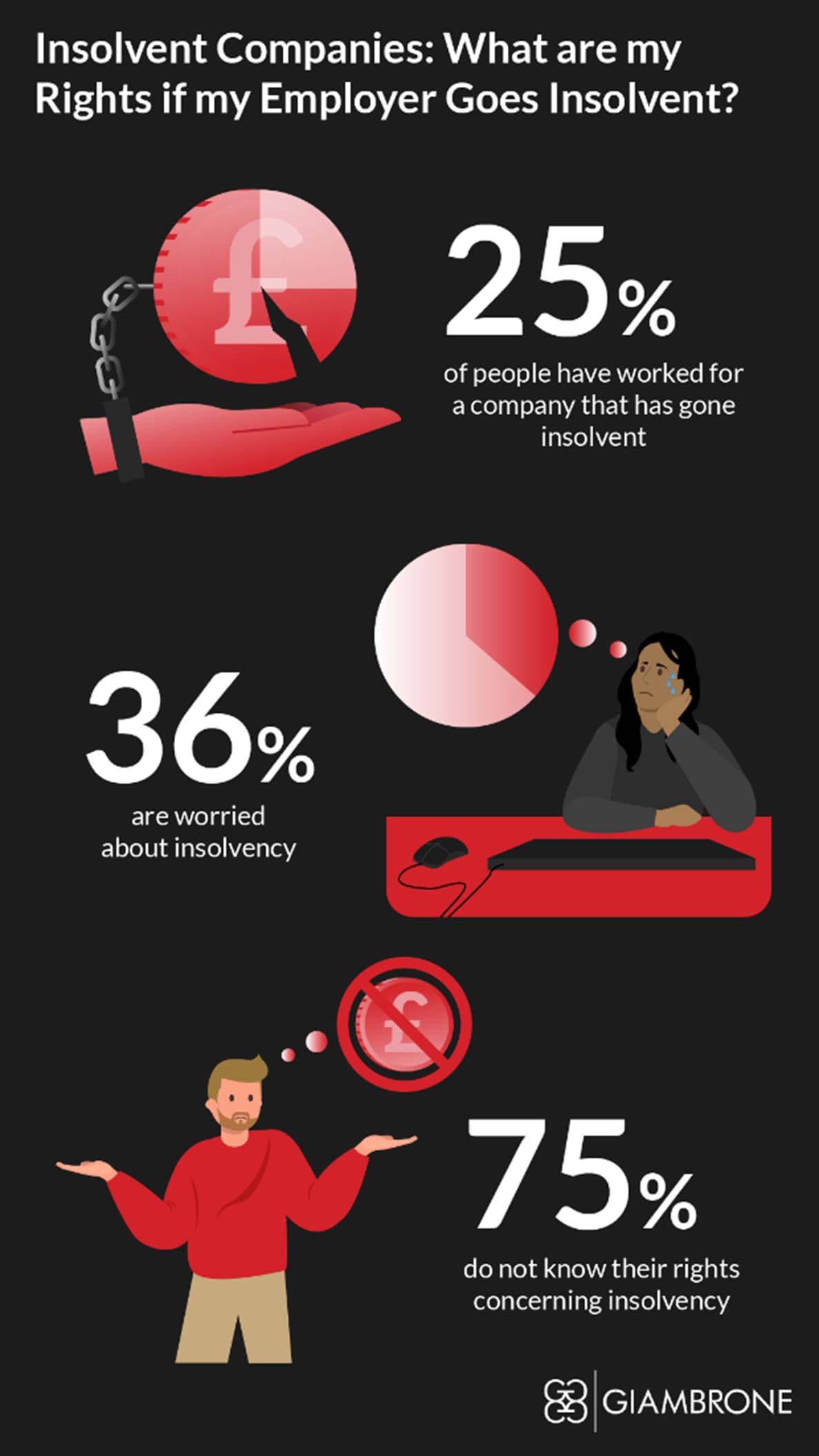

In 2023, over 25,000 businesses were made insolvent, leaving thousands of people unemployed. In our 2024 survey, we found that 34% of people are worried about insolvency and losing their jobs. If you are worried that your company may be made insolvent, you should make yourself aware of the various insolvency laws related to employees in England and Wales.

The primary insolvency laws in England and Wales are governed by the Insolvency Act 1986 and subsequent amendments. If your company becomes insolvent, this is known as it may enter administration, liquidation, or a Company Voluntary Arrangement (CVA). Administration is often the first option; this requires the compliance of shareholders and allows a business to trade out of the risky position. Not every business can successfully overcome a poor trading position and often liquidation is the only option.

England and Wales have provisions for dealing with cross-border insolvency cases, aligning with international frameworks such as the UNCITRAL Model Law on Cross-Border Insolvency. You can arrange a consultation with a cross-border insolvency lawyer at Giambrone and Partners to discuss your position. There are also regulatory bodies, such as the Insolvency Service in England and Wales, and the Accountant in Bankruptcy in Scotland.

It's important to note that insolvency law is complex and subject to change. Individuals and businesses facing financial difficulties should seek professional advice to understand their options and obligations under England and Wales insolvency laws.

If a company becomes insolvent, the employees become preferential creditors of the company. If the owner closes the business before insolvency, then all the redundancy rights fall into place.

If the business is closed before the business goes insolvent, or is closed because of insolvency, you have various rights that must be adhered to by your employer. However, according to our 2024 survey, 75% of respondents didn’t know their rights concerning insolvency. If your company is on the brink of insolvency, your rights include:

Redundancy Payments: If you are made redundant due to your employer's insolvency, you may be entitled to statutory redundancy pay. The amount you receive depends on factors such as your length of service, age, and weekly pay, up to a statutory maximum.

Unpaid Wages and Holiday Pay: Insolvency laws prioritise the payment of unpaid wages and accrued holiday pay. These payments are treated as preferential debts, meaning they are paid before certain other debts in insolvency proceedings.

Arrears of Pay: You may be entitled to arrears of commissions, bonuses, or other contractual payments. These arrears of pay are also treated as preferential debts in insolvency proceedings.

National Insurance Contributions: Any outstanding employer's National Insurance Contributions (NICs) related to your earnings should be paid. This ensures your entitlements to future social security benefits, such as state pensions and statutory sick pay, are protected.

Pension Contributions: In certain cases, your workplace pension contributions may be protected, ensuring they are paid into an appropriate pension scheme.

Employee Consultation and Information: You have the right to be consulted about redundancies and to receive information about the insolvency process and how it may affect your employment and entitlements.

Employee Representatives: In some cases, you may appoint representatives to negotiate with insolvency practitioners or administrators on your behalf, such as insolvency lawyers.

Government Support: The National Insurance Fund provides financial support for certain employee entitlements in the event of employer insolvency. This fund covers payments such as redundancy pay, arrears of wages, and holiday pay.

If you believe your employer has failed to follow through with any of the above points, you should seek legal advice as soon as possible.

You can seek legal advice as soon as you receive a notification of insolvency to enable you to understand your rights and options early. If your employer has not consulted you about possibly redundancy, and there are disputes over payments such as accrued holiday and wages, you should discuss your options with a legal expert.

If you wish to understand more about insolvency proceedings, or you wish to appeal a decision, you should seek legal advice.

Once your employer has explored all legal avenues with regard to saving the business, they should communicate openly and transparently with their employees. Employees should be informed about the impact on their jobs and entitlements.

If redundancies are necessary to avoid insolvency, the employer should follow legal procedures for consultation and redundancy. This includes consulting with employee representatives or trade unions and providing adequate notice and redundancy pay as required by law. Failure to do so could lead to employees taking necessary legal action.

If your employer has declared bankruptcy or become insolvent, you should seek legal advice if your employer has not been transparent with you throughout the process. If you feel that your rights as an employee have not been upheld, seeking legal advice could be the next step.

Our insolvency lawyers can assist you both in England and Wales and cross-border, have years of experience to help you get the results you need.

To find out more, get in touch with our insolvency lawyers today.

A Guide to Insolvency and How to Avoid It

New Insolvency Rules for Cross Border Matters

How to Make an Employee Redundant and Guidance on Redundancy